The 2026 Yield Gap: Why a Hybrid CeFi-DeFi Strategy Wins

By Steven Andros Published: February 12, 2026

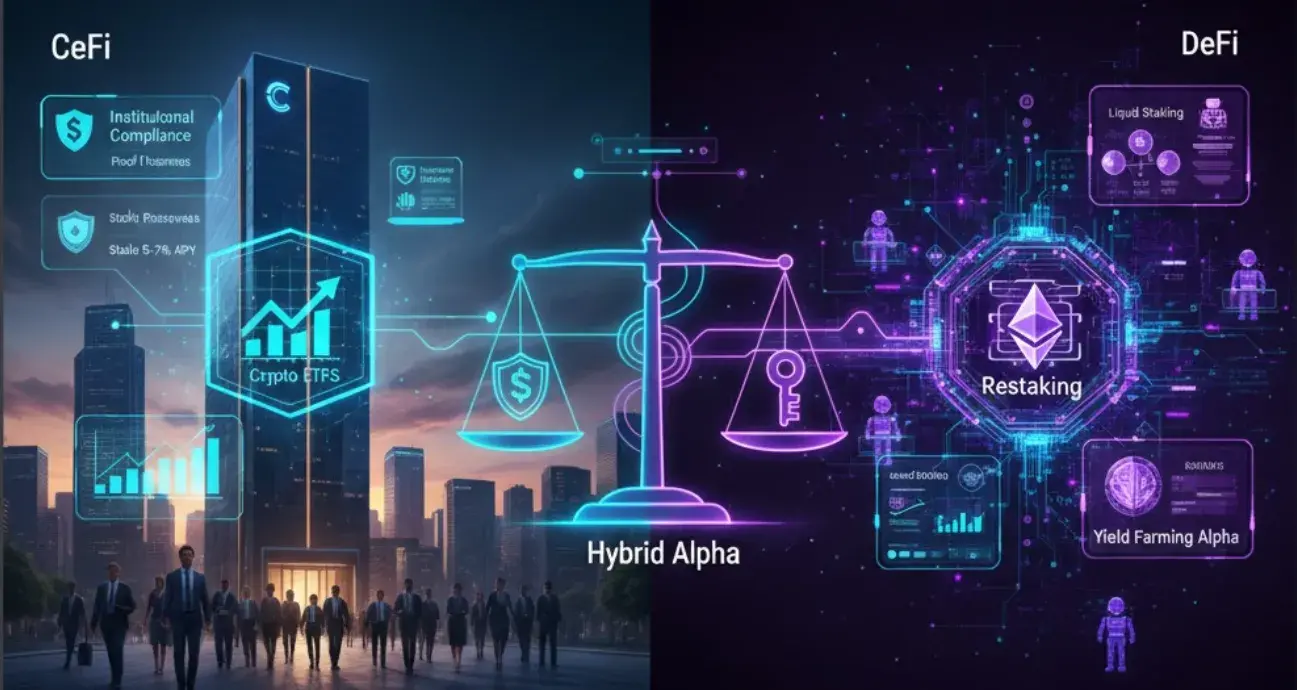

Quick Summary: As the gap between Centralized (CeFi) and Decentralized Finance (DeFi) narrows, 2026 investors are moving away from «all-or-nothing» mentalities. Success now lies in «Hybrid Alpha»—combining the institutional security of CeFi with the transparent, high-yield innovation of DeFi restaking and RWA protocols.

The New Reality of Digital Asset Yield

In the early days of crypto, yield was often a byproduct of unsustainable «vampire attacks» and inflationary rewards. As we navigate the first quarter of 2026, the landscape is fundamentally different. Institutional-grade regulation (like MiCA and the US GENIUS Act) has standardized the market, turning yield strategies into sophisticated financial operations.

Today, the most resilient portfolios aren’t just chasing the highest APY; they are optimizing for liquidity, security, and tax efficiency.

CeFi in 2026: The «Safe Haven» for Core Capital

Centralized Finance has evolved into a digital-first private banking experience. For investors who prioritize asset protection and regulatory compliance, CeFi remains the bedrock of their yield strategies.

Institutional Compliance and Insurance

Major CeFi platforms now operate with full federal bank charters or equivalent global licenses. This has introduced:

- Proof of Reserves (PoR): Real-time, on-chain verification of platform solvency.

- Integrated Insurance: Protection against platform-wide exploits or technical failures.

- Simplified Reporting: Automated tax documents that align with 2026 global standards.

The Rise of Managed AI Vaults

In 2026, «manual» lending is being replaced by AI-driven vaults. These platforms automatically move capital between various lending desks to maintain a steady 5–7% yield on stablecoins, providing a hands-off experience for conservative investors.

DeFi: The Innovation Engine for Alpha

While CeFi provides the floor, Decentralized Finance provides the ceiling. DeFi in 2026 is no longer a «Wild West» experiment; it is a highly efficient, automated financial machine.

The Restaking Revolution

The biggest shift in DeFi yield strategies this year is the dominance of «Restaking.» Protocols like EigenLayer have matured, allowing users to earn multiple layers of yield—base staking rewards plus additional «Actively Validated Service» (AVS) incentives—on a single asset.

Real-World Assets (RWA) as a Yield Floor

Perhaps the most significant breakthrough of 2026 is the tokenization of Real-World Assets. Investors can now access on-chain yield backed by:

- U.S. Treasury Bills: Bringing «risk-free» traditional rates into the DeFi ecosystem.

- Private Credit: Lending to verified real-world businesses via decentralized protocols.

- Fractional Real Estate: Earning rental income through tokenized property shares.

Assessing the 2026 Risk Spectrum

A successful strategy requires an honest assessment of the new risks present in the market.

| Risk Factor | CeFi Approach | DeFi Approach |

| Primary Threat | Counterparty (Platform) Insolvency | Smart Contract Vulnerabilities |

| Control | Custodial (Third-party manages keys) | Self-Custodial (You manage keys) |

| Regulatory Cover | High (Consumer protection laws) | Variable (Governed by code and DAO) |

¡Manténgase informado, lea las últimas noticias sobre criptomonedas en tiempo real!

The Verdict: Why «Hybrid Alpha» is the 2026 Standard

The most successful portfolios we see in 2026 don’t choose between CeFi and DeFi—they use both.

A typical Hybrid Alpha allocation looks like this:

- 60% CeFi: Core holdings (BTC, ETH, USDC) in regulated platforms for steady, insured yield.

- 30% DeFi: Liquid staking and RWA protocols for mid-tier growth.

- 10% Degenerative DeFi: Restaking and new Layer-2 «Alpha» farms for maximum upside.

This balanced approach ensures that even if a single protocol or platform faces a «black swan» event, the majority of the capital remains protected under different security architectures.